A robust governance framework may be one of the biggest drivers of long-term outcomes for a nonprofit organization. A defined governance process is a simple yet effective approach to ensure that Committees remain actively involved in fulfilling their fiduciary duties. While Committee members can sometimes fixate solely on investment performance, they need to be aware that analyzing spending trends or operating expenses could have an equally meaningful impact on mitigating costs and ultimately, portfolio performance.

We help clients succeed with a calendar-driven method, enabling the seamless integration of fiduciary responsibilities into the Committee’s regular meetings. Our Fiduciary Governance Calendar is divided into four broad topics shown below, which not only play a critical role in establishing a solid foundation and culture of governance, but also create a commitment to discussing the issues regularly. We believe each topic contributes to improving the governance process and helping Committee members become better stewards.

Quarter 1: Governance

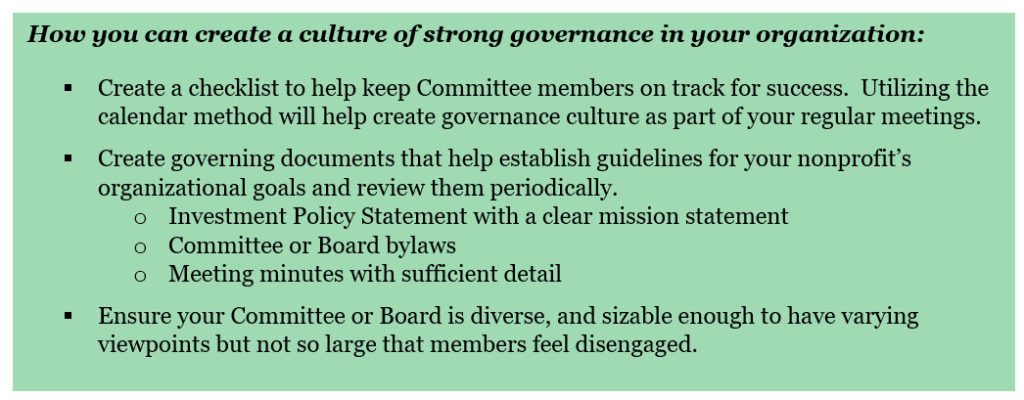

A governance ‘check-in’ is an excellent way for a committee to assess an organization’s strengths and opportunities. As fiduciaries, it is necessary to analyze internal factors that could hinder success. Often, a simple process such as keeping a best practices checklist allows nonprofits and Committees to self-evaluate if they are following necessary protocols and guidelines that maintain order and structure within the organization. Some other examples are as follows:

- Establishing regular meeting frequency (ideally quarterly) deemed necessary to achieve purposeful discussion and decision-making.

- Creating a formal agenda for each meeting in advance and distributing that agenda to all Committee members.

- Ensuring meeting minutes are reviewed and approved by all Committee members on time, providing sufficient context for newer members who join.

The Investment Policy Statement (IPS) supports the governance process by laying out the framework of the nonprofit’s mission and serving as a guide for the Committee. It is an indispensable governing document that should clearly outline organizational objectives and long-term goals. We recommend an annual review of the IPS in order to confirm objectives, roles and responsibilities along with any changes in risk parameters which should be documented. When revisiting an IPS, some questions important for Committee members to ask include:

- Are duties and responsibilities outlined clearly for new Committee members who join the organization?

- Do the investment objectives stated support the nonprofit’s mission and preserve the corpus?

- Does the Investment Policy Statement promote intergenerational equity?

Changes to the IPS should ensure that any added or edited language is relevant and aligned with the institution’s long-term objectives. Devoting time to consider and discuss these points will significantly impact the organization’s health by both refreshing the Committee members’ understanding of the goals and guidelines in place and ensuring they are still applicable.

Quarter 2: Portfolio Structure

Reviewing the program of investments at a more granular level helps Committee members comprehend the distinct contribution of each asset class, investment manager and strategy within the portfolio. A general sense of the portfolio’s attribution will allow Committee members to feel at ease during periods of market volatility. Being conscious of market conditions and expected market directions could help Committee members understand why the institution may be experiencing periods of underperformance or outperformance. Additionally, it helps the Committee stay cognizant of how different strategies and asset classes factor in and perform during certain market conditions.

Along with portfolio attribution, review of expense and liquidity structures is equally essential to ensure that an organization can meet its short-term financial obligations. Because of fluctuating revenue streams and the potential for unexpected cash flow needs, it is imperative for nonprofits to actively manage liquidity and expenses.

Quarter 3: Spending Policy and Trends

A regimented spending analysis is another fundamental element of strong fiduciary governance. Over time, spending and excessive fees can decrease returns, making it challenging to preserve the corpus. Regular review of the manager, custody and advisory costs, as well as other applicable fees, offers valuable insights into opportunities for enhancing net returns. When discussing spending and trend analysis, two key factors should be considered. First, the spending policy is the sole input the institution has complete control over and second, the spending policy is a significant factor influencing the funding of operations essential for supporting the organization’s mission.

As the committee becomes acquainted with spending patterns, regular reviews facilitate the identification of outliers and potential areas of unjustified overspending. The investment program depends highly on cost, as it is a significant predictor of future returns.

Quarter 4: Asset Allocation

It is widely recognized in the industry that strategic asset allocation is a significant indicator of long-term investment results. For example, Vanguard notes in their research that over a long period, more than 90% of the portfolio’s return variability is explained by the strategic asset allocation1. Adopting a strategic approach is essential for organizations dedicated to creating portfolios meant to endure well beyond our lifetimes. Although regular review of expected risk and return is prudent when evaluating the institution’s evolving goals and objectives, it is important to avoid becoming reactive to market conditions. When completing an asset allocation review, the Committee should focus on:

- Capital market conditions and assumptions.

- Any disconnect between the investment program and the institution’s goals.

- The strategic asset allocation to fit the market outlook.

These points should not be seen as a means for making short-term tactical shifts, but instead considered as critical components of the long-term strategy. We believe that staying committed to the portfolio’s long-term approach may provide the greatest chance for successful outcomes while meeting long-term objectives.

To help ensure proper governance is a priority at your organization. Creating a structure or routine to discuss and review governance topics regularly will help establish the foundation necessary to meet the nonprofit’s goals and even lead to successful investment outcomes over time.

Fiducient Advisors assists nonprofit organizations and Committees/Boards in establishing a robust fiduciary governance process through our Fiduciary Governance Calendar. We help clients construct custom investment strategies to meet their objectives and goals while serving as a trusted resource for our clients on a broad variety of topics. We understand that our work must help advance our clients’ missions, as investing for the benefit of others has never been more important. Therefore, we commit to helping Boards, Committees and staff perform as responsible financial stewards for the organizations they care about most. Whatever the objectives, we view ourselves as our clients’ “strategic partner,” striving to achieve their goals with less time, cost and burden.

For more information, please reach out to any of the professionals at Fiducient Advisors.

1Vanguard, Tactical versus strategic asset allocation, November 29, 2022

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.