As an experienced advisor, we stand ready to guide Plan Sponsors through the complexities and everchanging landscape of pension plans. This newsletter provides valuable updates from our dedicated Defined Benefit Business Council.

Stock Resiliency Amid Rate Volatility

Despite geopolitical tensions and tariff ping-pong, stock markets proved remarkably resilient, helping to improve pension funded statuses this quarter and effectively offsetting much of the negative performance experienced during the first quarter.

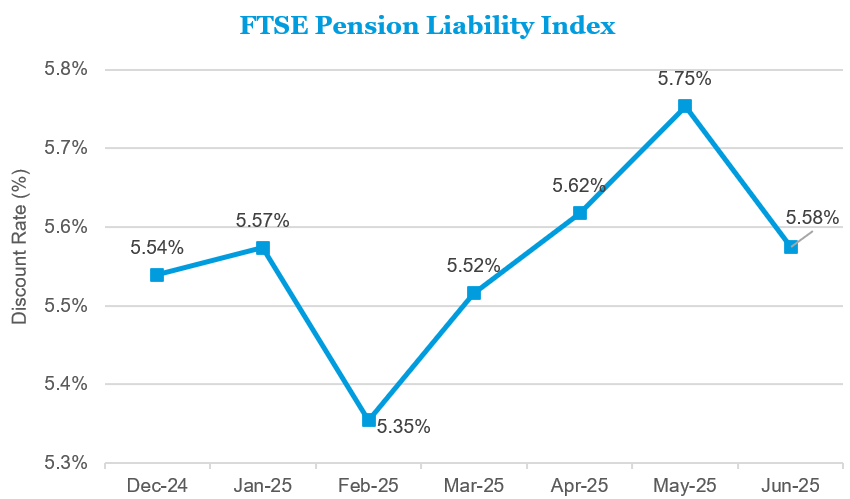

Although discount rates used to value liabilities declined to 5.58% in June and ended nearly unchanged from the beginning of the quarter and year, this perceived stability belied significant underlying rate volatility.

Source: Morningstar Direct as of 6/30/2025; FTSE Pension Liability Index provided by London Stock Exchange Group plc.

Traditional Pension Plans

| In general, pensions experienced another month of funded status gains in June to end the quarter and the year in a more favorable position due to robust stock market performance. Both of the composites we monitor showed funded status gains: the Russell 3000 companies average funded status ended June at 100.9% funded, bringing its year-to-date gain to 1% after losing 1% during first quarter. Plans with higher allocations to equities saw more robust gains versus the stability of plans with a higher allocation to liability driven investment strategies. |