Smart strategies to build and optimize your cash investments

After 15 years of low interest rate policies, cash is back as a more attractive investment in the new yield environment. However, investors may be rusty on what their options are for cash investments and how to best optimize their cash earnings. Cash can be an important tool to managing financial goals, but we caution that as a “long-term” investment it tends to underperform other asset classes. With that in mind, we explore some potential avenues to make your cash work harder.

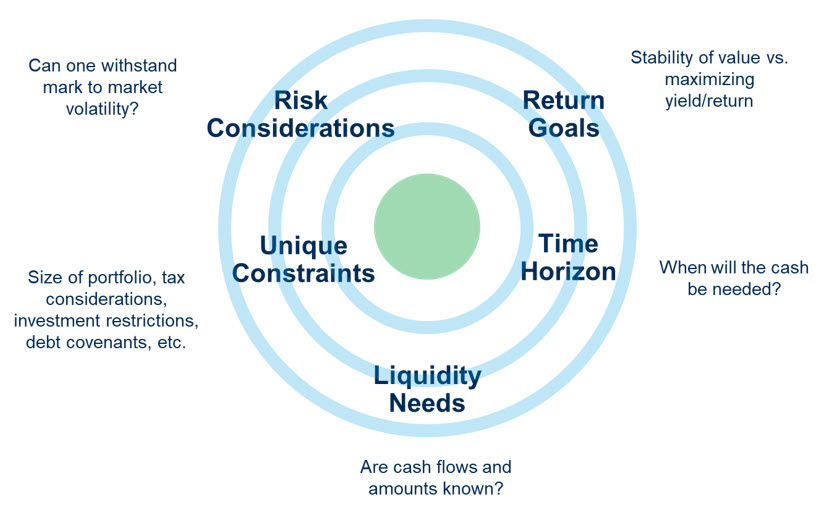

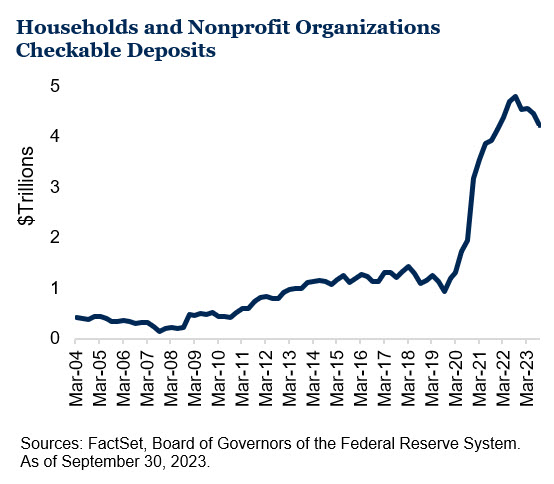

We witnessed an extreme buildup of cash deposits among households and nonprofit organizations, growing almost $3 trillion over the last three years1. There are three main avenues to take when it comes to cash investments: traditional banking products, purchased money market funds and ultra-short fixed income investments. While there is no one size fits all choice, the ultimate path depends upon a host of factors such as risk tolerance, return objectives, time horizon, liquidity needs and other constraints. With these considerations in mind, one can make their cash allocations more efficient and likely improve investment outcomes. So, in the words of the great John Fogerty, “Put me in, Coach! I’m [cash] ready to play.”

Traditional Bank Products

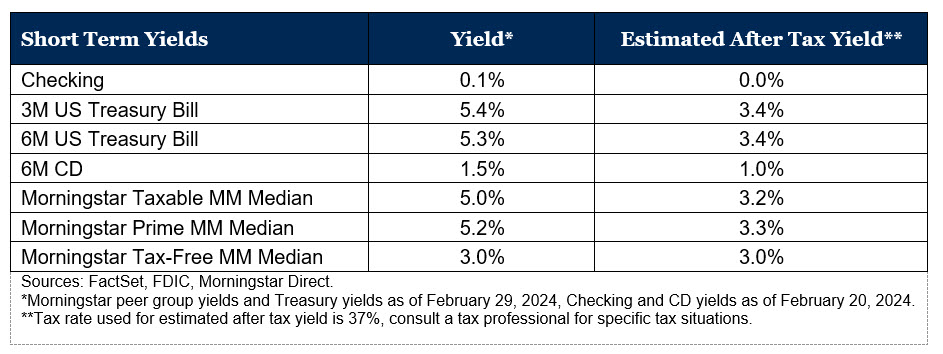

We begin with the simplest cash holding solutions of the group: checking accounts, savings accounts and certificate of deposits (CDs). Checking and savings accounts offer the most liquidity and direct access to physical cash – one can walk into the bank and withdraw funds. They are also insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC). However, this convenience comes with a low interest rate. The national deposit rate on interest checking accounts in February was 0.1% according to the FDIC.2 Savings accounts may offer a slightly better return potential than checking accounts, but still fall short of other “cash” alternatives that exist for investors.

CDs are the next step up the ladder, offering marginally higher interest rates than checking accounts (national average of 1.5% for a 6-month CD2) and the same FDIC insurance. The advertised yield of a CD will vary from institution to institution, but it is important to remember that CDs are essentially short-term loans to a bank. Just like a bank will charge a borrower a higher rate for a riskier loan, the same principle applies here; there is “no free lunch,” a higher-than-expected CD rate may be higher for a reason. Additionally, it is important to remember these funds are illiquid for the duration of the CD and may include penalties for withdrawing early.

There is certainly a need for having a portion of assets in traditional bank products like checking/savings accounts – the need to pay bills, etc. – but keeping all of one’s cash in these low interest accounts is likely suboptimal. If there are cash assets above the levels of daily needs, investors should consider other options such as purchased money market funds and ultra-short fixed income discussed below.

Money Market Investments

For investors that want to maintain liquidity and preserve principal, but do not need “instant” access to cash, purchased money market funds should be considered. Money Market funds provide more attractive yields compared to traditional banking products (see “Short Term Yields” table below) while aiming to protect capital and not overly sacrificing liquidity. Many of these strategies are daily liquid 40-act mutual funds and, like other mutual funds, can be bought or sold within a day, making funds available quickly but not instantly like a traditional bank account.

There are three primary types of money market strategies: government, prime and tax-free/muni. Each category offers different underlying investment exposures and risks, but all aim to deliver a stable net asset value (NAV) while providing interest income. Government money market funds, as the name suggests, invest in government issued debt or debt backed by the U.S. government, such as U.S. Treasuries, Agencies and repurchase agreements. Prime money market funds may also invest in other areas of the fixed income market such as corporate issued commercial paper, among others, and muni money market strategies aim to invest in issues from state and local governments that are tax advantaged. It is important to note that prime and muni money market strategies may impose a liquidity fee in a period of extreme cash flow withdrawals from the fund, while government only money market funds do not. Given the yield premium offered by money market funds above traditional banking products, an allocation to a money market strategy can make your cash “work harder” and earn more than just sitting in a bank, but the type of money market fund will depend on risk and tax considerations.

Ultra-Short Duration Fixed Income

As investors’ time horizons and/or risk tolerances increase, investments in ultra-short duration fixed income strategies may complement existing cash holdings. These total return-oriented strategies often come with the potential to earn a return above those offered by traditional banking products or money market funds.

Historically, ultra-short fixed income strategies have offered a 50 to 100 basis points return premium over money market strategies3. However, these investment strategies carry more traditional investment risks compared to bank or money market strategies. As the name suggests, duration, or interest rate sensitivity, increases with ultra-short strategies compared to money market funds. These strategies typically have a duration profile from ½ to 1 year. This can benefit investors if interest rates fall (bond prices move in the opposite direction of interest rates) or could be a headwind if interest rates rise. One could simply own bonds to maturity to mitigate the interest rate risk, but the tradeoff is a lower total return potential if interest rates decline. Additionally, an actively managed ultra-short fixed income strategy has greater flexibility allowing the opportunity to take advantage of market inefficiencies. For investors with a longer time horizon, and are willing to accept the potential risks and modestly higher volatility, an allocation to ultra-short duration fixed income strategies may further enhance the returns on one’s cash investments.

Can Your Cash Work Harder?

Assessing your cash needs by identifying your objectives and constraints is the first step to determine a cash strategy. There is no “right” way to allocate cash investments and the ultimate allocation among traditional checking accounts, money market funds or ultra-short duration fixed income will vary. However, there is a “wrong” way. Allocations to cash that lack intentionality may not align with investors’ objectives and risks or may leave return potential on the table. In this environment with attractive yields, it is important to consider the options on the table in order to maximize your cash.

If you would like more information, please reach out to any of the professionals at Fiducient Advisors.

1Board of Governors of the Federal Reserve System. As of September 30, 2023

2FDIC. As of February 20, 2024, www.fdic.gov/resources/bankers/national-rates/previous-rates.html

3Morningstar Direct. As of December 31, 2023.

Material Risks

• Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

• Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.