As Markets Evolve, Research Processes Must Adapt

At the outset of the decade, there was an apparent uptick in both interest and demand for “ESG” (Environmental, Social and Governance) in investment portfolios. Due to a confluence of factors, investors began seeking strategies or funds emphasizing ESG. Investment firms were quick to respond – adding new products and strategy launches as well as updating marketing materials to showcase “ESG” capabilities. Investors may have bought into such strategies based on fund labels or marketing materials alone, without looking deeper at the specific fund manager’s approach. In fact, the demand and response were so sharp that regulators ultimately proposed new rules to ensure fund names reflected actual ESG practices. If we fast-forward several years later, we find more recent money flow data suggests ESG investments are under greater scrutiny and investors are moving away from such strategies that underperformed. We don’t see this as investors reversing course on ESG interest; instead, we believe investors are beginning to understand the importance of having an investment due diligence process for assessing a manager’s approach and methods for considering ESG factors. Fiducient Advisors believes this remains crucial to identifying viable and compelling strategies.

The Initial Framework

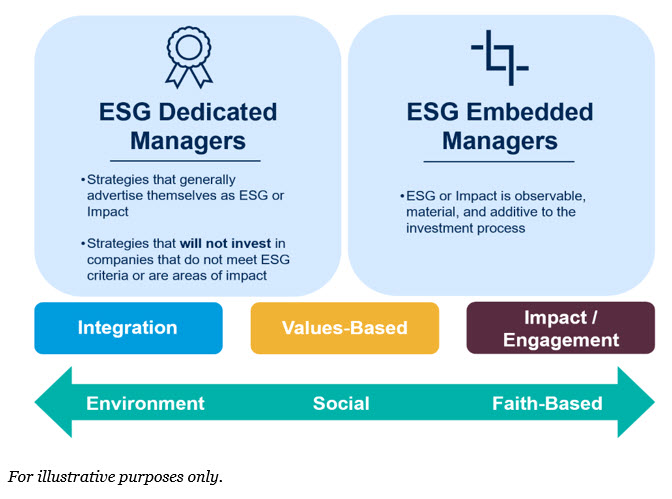

Since ESG can be implemented in an investment process in myriad ways, it is necessary that we understand and define each dimension of approach. We broadly categorize ESG investment strategies into two main types: “ESG Dedicated” and “ESG Embedded.” The former intentionally prioritizes ESG or impact. This means excluding companies that don’t meet predefined ESG criteria (i.e., applying a negative screen) or investing in those that contribute to greater good. On the other hand, “ESG Embedded” strategies do not explicitly market themselves as such, though the investment process will include consideration for ESG risks/opportunities. Both categories require deep diligence to assess the quality and strength of ESG integration.

With more asset managers than ever reporting ESG as a part of their traditional investment process, ESG incorporation can be difficult to assess. Thus, the onus is on the due diligence effort to distinguish which managers are incorporating ESG strategies in a meaningful way. In determining whether a strategy is “ESG Embedded,” we follow three primary guidelines:

1 – Is ESG observable in the investment process?

2 – Is ESG material to the investment process?

3 – Is ESG additive to the investment process?

It is noteworthy that asset managers embedding ESG may not manage strategies with it explicitly in mind, unlike dedicated ESG approaches.

Enhanced Due Diligence Process

The process begins like traditional investment due diligence, whereby we screen the universe for ESG dedicated strategies with organizational and team stability, reasonable asset sizes, favorable risk-adjusted returns and competitive prices. Publicly available information is reviewed along with 3rd party sustainability ratings to determine if further diligence is warranted. At this stage, our team can quickly discern investment strategies that incorporate Values-Based investing screens through public disclosure from the manager. We then develop an understanding of the nature of screens used, whether tilting into companies that promote ESG values (positive screen) or excluding companies that conflict (negative screen).

For strategies that pass our initial screens, we conduct a series of diligence rounds to assess both the merit of their investment and ESG process(es).

ESG “Integration” is the most common and yet most difficult to diligence as it has the widest variation of approach. We generally look for asset managers that consider non-financial information across environmental, social, or governance criteria as a part of their investment thesis for a company. Examples of this include having a dedicated ESG-research team that reviews ESG performance and assesses materiality with respect to a range of possible financial outcomes including operations, risk mitigation, efficiencies, brand competitiveness and revenue generation. We also observe Engagement/Impact including direct dialogue with companies, filing of shareholder resolutions and proxy voting. Impact investing is most relevant to private markets. There we attempt to diligence how the direct investment in certain companies will directly benefit the environment or social causes it is connected to.

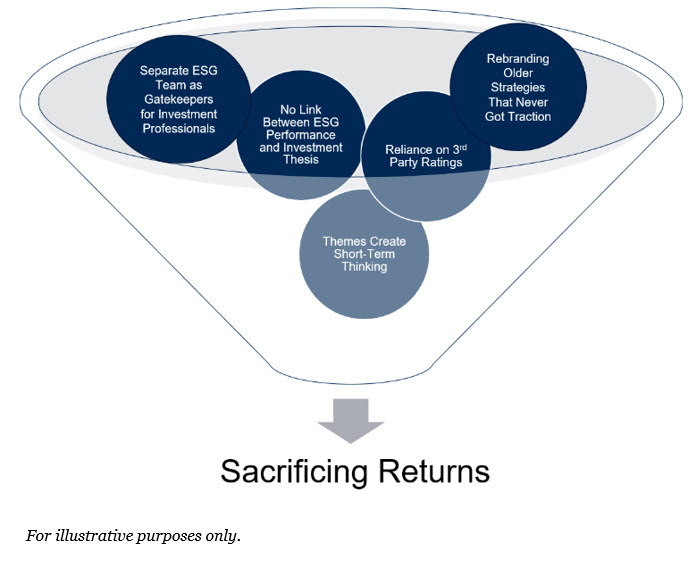

Possible pitfalls in ESG investing exist, which have the potential to compromise returns or fail to generate substantial value. As research professionals, we demand evidence during due diligence on any strategy claiming ESG incorporation. Common concerns with managers center around the lack of evidence of true ESG integration, prompting us to request examples of dedicated ESG teamwork, review of memos and research output, examination of models and data inputs for screens and documentation of engagement successes/failures with corporate management. This diligence aligns with our standard investment process, emphasizing screening, qualitative and quantitative assessment and multiple rounds of diligence discussions.

Importantly, we believe that the managers selected for our ESG platform are as effective as other standard (non ESG) options, and they possess specific competitive differentiators. In a landscape marked by ESG product proliferation, closures of underperforming products and increased marketing efforts, our process and framework for assessing ESG attempt to bridge clients’ aspirations to fulfill their mission without sacrificing returns.

The Importance of Ongoing Monitoring

Today we maintain a reasonable yet substantial list of approved ESG strategies across dedicated and embedded strategy types and we monitor the following factors:

• Generation of a quarterly quantitative score

• Tracking of relative returns and other KPIs versus expectations

• Collection of quarterly questionnaires containing qualitative information

This process is supplemented by additional resources through 3rd party providers that we use to assess ESG specific data points and ratings.

By adhering to our rigorous due diligence processes and discerning between ESG Dedicated and ESG Embedded strategies, we believe clients can navigate the complexities of ESG integration more effectively and create well-rounded portfolios. Moving forward, the continual evolution of ESG investing requires investors to remain vigilant and adaptable.

A disciplined process enables investors to stay ahead of emerging trends, identify opportunities and mitigate risks effectively. Moreover, it fosters transparency and accountability, which we believe is important to share with clients. By having a roadmap for navigating the complexities of the ever-changing ESG investment landscape, we believe we can unlock value in an increasingly interconnected world.

Fiducient Advisors has decades of experience working with clients to advise on ESG strategies as part of our approach to Mission-Aligned Investing (MAI). This also encompasses the realms of Socially Responsible Investing (SRI), impact investing, sustainability-based investing and Diversity, Equity and Inclusion (DEI) criteria. We assist our clients with Mission-Aligned Investing in the following ways: 1) We rely on our clients to share their beliefs with us, rather than us telling them what their beliefs are or should be; 2) We seek a practical approach to implementation; and 3) We strive to avoid sacrificing return in order to align client capital with client beliefs and values. Our ESG and MAI process is structured to be client-centric and is therefore driven by the specific values prioritized by the institutions they represent. If you would like to learn more about our approach or our due diligence process, please reach out to any one of the professionals at Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.