Year-end planning could prove more challenging in 2021, given continued uncertainty over tax reform. The social safety net and climate bill known as the “Build Back Better Act” (BBBA) has been tied up in negotiations for months, given competing priorities on when to pass the infrastructure bill versus the spending bill. While the infrastructure bill ultimately passed and has since been signed into law by President Biden, the outlook for BBBA remains in question, albeit with some recent traction.

On Friday, November 19, the House passed the measure by a vote of 220-213 (along strict party lines). Attention now turns to the Senate, which will consider the bill over the coming weeks. Amid an evenly divided Senate (50-50) and with the expectation of no Republican support, centrists Joe Manchin (D-West Virginia) and Kyrsten Sinema (D-Arizona) will wield considerable power in upcoming negotiations. Passing BBBA using a process called ‘reconciliation’ will ultimately require unanimous Democratic support in the Senate (50 votes). Senate Majority Leader Charles Schumer (D-N.Y.) has cited a goal for the Senate to pass the bill prior to Christmas, though that timeline may be in question.

With the possibility that tax reform could be passed just prior to year-end, taxpayers should engage their team of trusted advisors to determine whether planning strategies (such as those outlined below) might yield meaningful tax savings.

1. Utilize the Lifetime Gift Tax Exemption

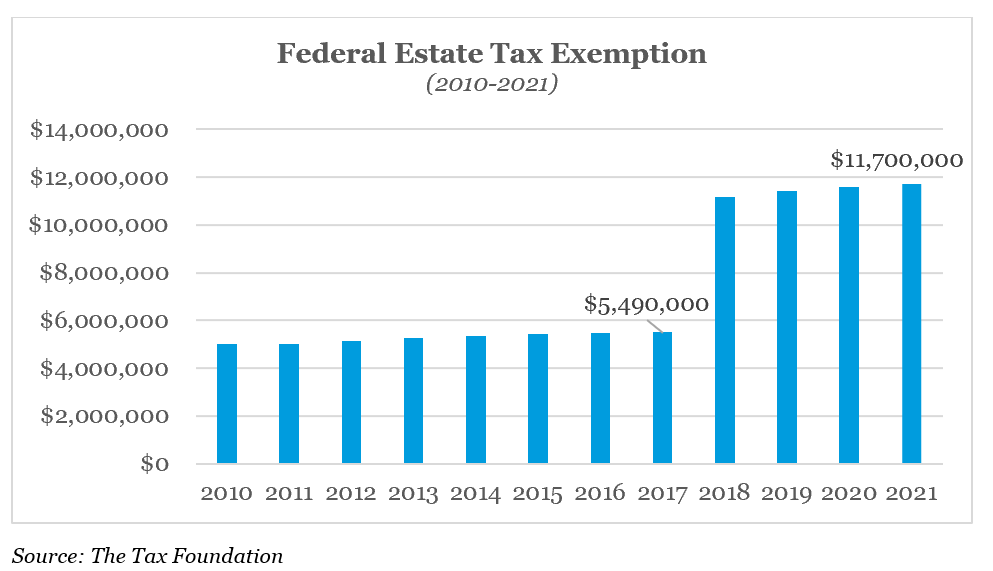

The Tax Cuts and Jobs Act (TCJA), which passed in December 2017, approximately doubled the estate exemption – from $5.49 million per person in 2017 to $11.18 million per person in 2018. For 2021, the lifetime gifting exemption currently stands at $11.70 million per person, with a top federal estate tax rate of 40 percent. The increased exemption amounts, under TCJA, are scheduled to run through 2025, after which the basic exclusion amount (BEA) is set to revert to the 2017 level of $5 million per person, plus inflation adjustments.

President Biden previously expressed a desire to return the estate exemption to ‘historic norms,’ which led tax experts to assume a decrease in the per-person exemption to $3.5 million or $5 million, plus inflation adjustments. In September, the House Ways and Means Committee released its initial draft of legislation, which would have reduced the exemption to $5 million per person, plus inflation adjustments, beginning as of 2022.

To the delight of affluent individuals, the House’s recently passed version of BBBA did not pursue changes to the estate exemption or to existing grantor trust rules. The Senate could choose to address these items in its draft, though that seems unlikely given the even divide in the Senate and earlier pushback from Senator Sinema on tax increases for individual taxpayers.

While the elevated exemption might remain in place through 2025, high net worth individuals should not lose perspective of the unique planning opportunity to get additional assets out of one’s taxable estate.

High net worth individuals should evaluate current assets and assess how much might be needed for their remaining lifetime, with consideration to gift ‘excess assets’ to loved ones. Depending on the size of an outright gift, estate planning which incorporates making gifts to trusts may be advisable to provide parameters or safeguards for the intended beneficiaries.

As a reminder, the Treasury Department and IRS issued final regulations in November 2019 clarifying that taxpayers taking advantage of the increased exemption amounts would not be subject to a future clawback, should the exemption amount decrease from current levels.

2. Accelerate Charitable Donations

Charitably inclined individuals who might reasonably expect to be in a lower tax bracket next year should consider accelerating charitable gifts prior to year-end. A common example of this might be an individual who retired earlier this year and who will, consequently, have much lower taxable income next year. Another example would be an individual who had a much higher-than-normal income year. In such instances, it may be beneficial to group multiple years’ worth of gifting into a single tax year while income is subject to a higher tax bracket.

Also, many provisions of the CARES Act (from 2020) were extended to 2021. Among the special provisions, individuals may deduct up to 100 percent of AGI for 2021 charitable gifts for cash donations made directly to a public charity (not to a donor-advised fund). This enhanced deduction (versus the typical 60 percent deduction for cash donations) may provide an additional planning opportunity.

Gifting Long-Term Appreciated Securities Rather than Cash

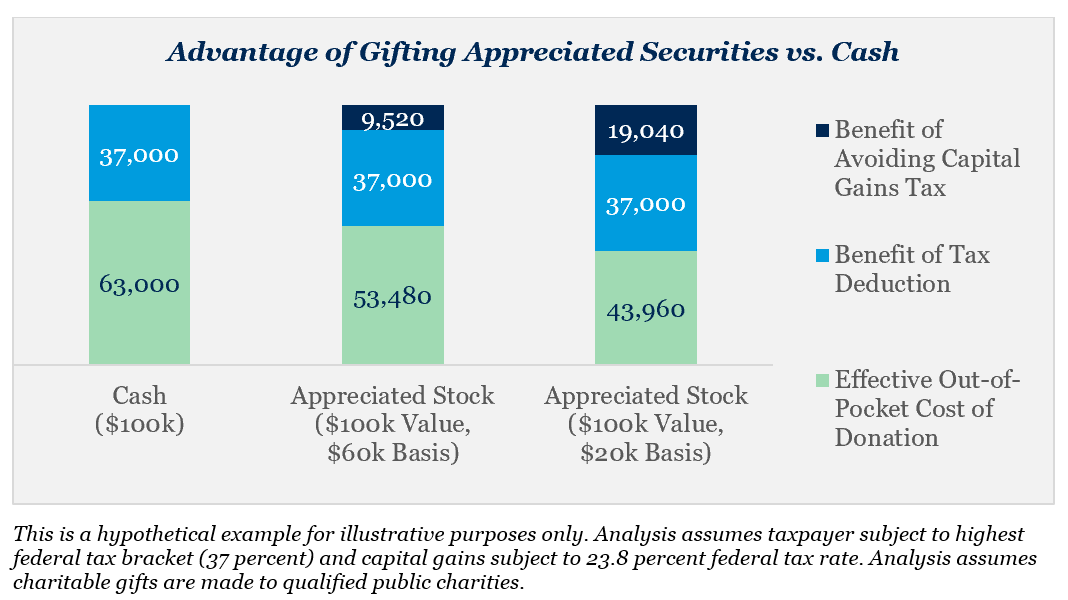

With equity markets near all-time highs, investors with taxable accounts may hold highly appreciated equity positions. From a tax planning standpoint, gifting long-term appreciated securities is a very efficient charitable-giving strategy as the charity receives the same economic benefit as a cash donation, while the taxpayer receives a tax deduction for the full market value of the gift and avoids paying capital gains taxes on the gifted security.

Investors who have a portfolio overweight to equities may use charitable gifting as a means to rebalance back to target weights. In doing so, an investor can achieve philanthropic goals while avoiding having to sell appreciated equities to return to a desired target allocation.

Keep in mind that gifts of long-term appreciated securities to qualified public charities (including donor-advised funds) are limited to 30 percent of adjusted gross income (AGI) while similar gifts to a private foundation are limited to 20 percent of AGI. Charitable gifts in excess of the AGI limits result in a charitable carryforward which can be used over the next 5 years.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.